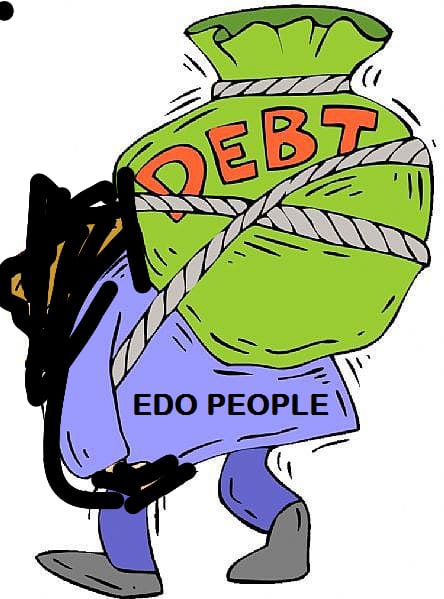

Edo State Debt Profile

Edo State has been a focal point of economic discussions and analyses due to its significant debt profile. As an integral part of Nigeria’s economy, the financial health of Edo State is a critical issue that impacts not only the state’s development prospects but also the broader economic stability of the nation.

However, the debt dynamics of Edo State require a comprehensive look at both historical and current financial data. Over the years, the state has accumulated substantial debt through various means, including domestic borrowing, external loans, and bonds. This accumulation has been driven by a range of factors, from the need to finance critical infrastructure projects to managing budget deficits and economic fluctuations. By dissecting these elements, we aim to provide a clear and detailed picture of the state’s fiscal condition.

Which State has the lowest debt in Nigeria?

According to the latest data from the National Bureau of Statistics (NBS) for the second quarter of 2023, Jigawa State has the lowest domestic debt in Nigeria, reported at N43.13 billion. This figure reflects the state’s prudent financial management and commitment to maintaining a sustainable debt profile, which is essential for economic stability and growth.

Jigawa State, situated in the northern region of Nigeria, has consistently worked towards improving its fiscal policies to ensure minimal reliance on domestic borrowing. This approach contrasts sharply with many other Nigerian states that grapple with significant debt burdens, often resulting in financial strain and limited funds for development projects.

The low debt level in Jigawa can be attributed to several strategic measures implemented by the state government. Firstly, the government has prioritized increasing its internally generated revenue (IGR). By diversifying its revenue streams, the state has reduced its dependency on federal allocations, which are often subject to fluctuations. Investments in agriculture, solid minerals, and small and medium-sized enterprises (SMEs) have been key to boosting the state’s IGR.

Secondly, Jigawa State has adopted stringent expenditure controls. The government has focused on cutting unnecessary costs and ensuring that public funds are judiciously utilized. This includes transparent procurement processes and a zero-tolerance policy for corruption, which has helped to prevent financial leakages and mismanagement.

Another critical factor in Jigawa’s financial prudence is its emphasis on infrastructural development that directly impacts economic growth. The state has invested in critical sectors such as education, healthcare, and transportation, ensuring that these investments yield long-term benefits for the economy. By focusing on high-impact projects, Jigawa ensures that borrowed funds, when utilized, are channelled into ventures that will generate returns and facilitate repayment.

Moreover, Jigawa’s administration has engaged in proactive debt management strategies. This involves regular monitoring and evaluation of the state’s debt portfolio to ensure that debt levels remain sustainable. The state’s approach includes negotiating favourable terms for any necessary borrowing and prioritizing concessional loans with lower interest rates and longer repayment periods.

In comparison to other states, Jigawa’s financial strategy stands as a model of effective debt management. While many Nigerian states are burdened with high domestic debts, often due to poor financial planning and excessive borrowing, Jigawa has demonstrated that disciplined fiscal policies and strategic planning can lead to sustainable economic health.

The lessons from Jigawa’s approach are pertinent for other states struggling with high debt levels. By adopting similar measures such as boosting internally generated revenue, enforcing strict expenditure controls, and focusing on high-impact investments other states can work towards reducing their debt burdens and achieving financial stability.

The Significance of Edo State Debt Profile

Understanding the debt profile of Edo State is crucial in assessing its economic health and future growth prospects. The debt profile encompasses both the state’s domestic and external debts, reflecting its borrowing habits and financial management strategies. As a key component of fiscal policy, the debt profile provides insights into how the state balances its development needs with financial sustainability.

Edo State’s debt profile is significantly influenced by its commitment to economic development and infrastructure improvements. The state government has embarked on numerous projects aimed at enhancing transportation networks, healthcare, education, and energy supply. These investments are designed to stimulate economic activity, attract investment, and improve the quality of life for residents. However, financing these projects often requires substantial borrowing, contributing to the state’s debt.

The significance of Edo State’s debt profile also lies in its approach to fiscal responsibility and debt management. The state government has implemented various measures to ensure that borrowing remains within sustainable limits. This includes strict adherence to debt management guidelines, regular monitoring of debt levels, and transparent reporting practices. By maintaining a disciplined approach to borrowing, Edo State aims to avoid the pitfalls of excessive debt, which can lead to financial instability and reduced investment capacity.

Edo State’s ability to manage its debt is closely tied to its revenue generation and diversification strategies. The state has made concerted efforts to increase internally generated revenue (IGR) through reforms in tax collection, enhancement of public sector efficiency, and promotion of private sector investments. Diversifying revenue sources reduces dependence on federal allocations, which can be unpredictable, and provides a stable financial base to support debt servicing.

The debt profile of Edo State has a direct impact on the provision of public services and social programs. High debt levels can constrain the state’s budget, limiting its ability to fund essential services such as healthcare, education, and social welfare. Conversely, well-managed debt can facilitate the expansion and improvement of these services. For instance, borrowed funds directed towards building new schools or hospitals can significantly enhance the state’s human capital and overall social development.

Edo State’s debt profile plays a critical role in shaping investor confidence and creditworthiness. A manageable debt level indicates sound financial practices and the ability to meet debt obligations, making the state more attractive to investors. This can lead to increased foreign direct investment (FDI), which is vital for economic growth and job creation. Additionally, a positive debt profile can enable the state to secure more favourable borrowing terms in the future, reducing the cost of financing development projects.

Edo State Debt Profile

Edo State has seen a significant increase in its external debt profile over the past year. In 2023, the state’s external debt surged to $314.45 million, a notable rise from $261.15 million in 2022. This leap has positioned Edo State as the third highest in terms of foreign debt among Nigerian states, as per the latest available data for 2023.

This sharp increase in external debt is a cause for concern and prompts a deeper examination of the factors driving this financial trajectory. The additional $53.3 million in debt accumulated over the year raises questions about the state’s fiscal policies, economic management, and the sustainability of its financial commitments.

The increase in debt can have several implications. Firstly, higher debt levels may strain the state’s financial resources, diverting funds from essential services and infrastructure projects to debt servicing. This could impact the quality of life for residents and slow down development initiatives. Secondly, increased debt might affect the state’s creditworthiness, making it more expensive to borrow in the future.

Addressing the rising debt requires strategic financial management. The state government needs to implement measures to boost revenue generation, such as improving tax collection mechanisms, encouraging investment, and diversifying the economy. Additionally, prudent expenditure management and prioritizing projects with high economic returns can help in managing the debt more effectively.

Wrap Up

While the latest debt profile paints a concerning picture, it also presents an opportunity for Edo State to reassess its financial strategies and implement reforms that can lead to sustainable economic growth. The state’s leadership must focus on leveraging its cultural and natural assets to attract tourism and investment, thereby increasing revenue and reducing dependence on external borrowing.